Behind the scenes of almost every loan and type of loan in America is a credit report and its credit score. Making credit and the credit score, an instrumental part of banking and borrowing. With such a significant impact on lending and the economy, laws were put in place to protect the consumer and the banking system by ensuring fair and accurate credit reporting. But what about a fair and accurate credit score? Who’s governing that? What if there is a glitch in the algorithm? What if the score was programmed to respond to information purposed for another reason? That could be a total disaster in the whole lending process. Right? And if that was the case, what would you do? The Fair Credit Reporting Act gives the consumer the right to dispute any inaccurate information on their personal credit report. However, the consumer is not able to dispute the credit score. Why would it? The score is only as good as the information provided right?

Wrong! There are defects in the mathematical algorithm called “FICO” and there are no laws currently governing it. Oh, and to make things worse, the collection agencies exploit these specific glitches for their benefit. If I have your attention so far, let’s dive in as I expose some truths about FICO.

If we were to argue what the most important part of the consumer’s credit is – Johnnie Cochran himself, would struggle to argue against the fact that it is indeed the FICO credit score. Not only does it determine interest rates; it is most often the sole factor in determining approval or a denial. The reason for this is that portfolio and investment value is largely assessed on those scores. This is a whole different blog in itself; but basically the lender’s ability to sell the paper, or turn the investment, is mostly factored on the scores within the package of loans. Consequently, the credit score has far more impact on buying power than the context and itemized history. This includes paid off accounts, on-time payments, and how much time they’ve been on the bureau. In almost every situation a lender’s approval authority is determined by this 3 digit number. I think we can all agree that the credit score is the most important factor. Then why in the hell is the score not addressed in any of the 106 pages of the FCRA – the Fair Credit Reporting Act!?

First off, I want to establish the fact that FICO is NOT owned by the Credit Bureaus. These are separate legal entities with their own tax ID numbers, addresses, employees, etc. Without going into a full report on this and making it more than just cool trivia, I’m going to touch on some relative facts.

FICO provides a mathematical algorithm formulated to assess the risk, or likelihood, of a consumer defaulting on original terms of an agreement.

FICO based these risk levels and their related coding on the performance of thousands of previous loans and the related statistics there of.

FICO, the company, did not go into an agreement with the Credit Bureaus, but rather went into an agreement with the third-party companies who purchase and format the Credit Bureaus’ information and then sell it to lenders and retailers. They also purchase the FICO scores themselves, as well as public record information, and integrate it all into one report that most lenders are familiar with. Consumers do not have access to these reports and probably would not recognize these third-party providers. However, anyone associated in the lending world would recognize these companies with names like Credco, Kroll, Credit Plus, etc.

FICO has then kept their algorithms proprietary and under lock and key. The whole agreement as far as a business deal was pretty brilliant. Having circumvented the Credit Bureaus by going into a relationship with the third-party providers, this kept FICO out from under the FCRA umbrella which guaranteed them to be the link between a consumer and almost every potential loan in America. The third-party companies then sealed the deal by forcing an agreement with FICO to keep them from selling their scores to any consumer or outside agency, including the Credit Bureaus themselves.

Kinda smells like a monopoly. FICO gets paid on every loan application in America. Although it might have been a fantastic business move, consumers are suffering over the arrangement. This also helps to explain why monitoring companies – like Credit Karma – have scores that do not match FICO credit scores. This includes the Credit Bureaus own monitoring programs like MyFico – or as we like to call them “FAKO” scores. This is, as we’ve seen in recent news, why Equifax and Transunion were fined $23 million for false advertising as they claimed they were providing the same scores the bank sees. Hang with me, all this is relative.

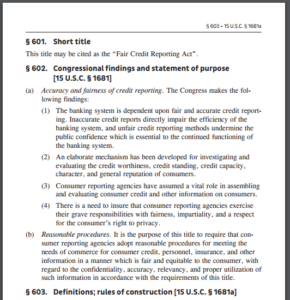

The FCRA was established and purposed for this reason – see image below.

Notice the recognition of the information and its relevance in lending and the economy itself? This is such an important issue that affects everyone – not just those impacted with inaccuracies.

The whole purpose of the Act is to ensure that something so important, is reported fairly and accurately. This information includes payment history on accounts, types of accounts, payment status of accounts, and pertinent details such as balances and dates associated with when accounts were opened, closed, and updated. It also includes important dates indicating when an account went delinquent, charged off, etc. All of these of which the FCRA insists is being reported accurately and addresses the consumer on how to dispute that information if it is not.

This same information is also relevant when determining the risk level of a consumer. This information is coded and put into a system that is then calculated using the FICO algorithm. However, nowhere in the Fair Credit Reporting Act does it address the credit score – it acknowledges the grave importance credit reporting plays in our modern day economy and governs that – but not the importance of the credit score. And even though we all know how important credit scores are somehow they still go ungoverned. I can hear the voices now as write this, “FICO is only as good as the information provided!” BS! Read on.

Let’s look into how the credit score calculates the information provided by the Credit Bureaus. You can read my blog here for deeper details on this. Although the credit score algorithm is proprietary and no one has the exact formula, we do know some basic significant factors.

We know that Payment history makes up to 45% of the credit score and that part of the score is largely scaled on time. And time obviously contributes to another scoring factor, “time on the bureau” and age of accounts – which means timing or relative dates makes up to 70% of the credit score in one way or another.

When it comes to a derogatory account, we know that the more recent the account the greater of an impact it has on the credit score regardless of the type of account or the amount of the debt. Any derogatory within the most recent 24 months makes up to 75% of the payment history section of the score. Remember that the scoring of a consumer’s risk level was scaled on the performance of thousands of loans and many of those statistics were calculated on when the consumer may have fallen on hard times and on how they have done since. This information plays a vital part in the consumer’s credit score, therefore accurate dating is paramount. The credit score was programmed to translate these dates into its algorithm accordingly. However, it’s reasonable to assume the score is only as accurate as the information provided but here lies the problem.

Not all of the information provided by the credit bureaus has been coded correctly. There are several things that seem to be wrongly coded starting with the way FICO ages a collection account based on when the collection agency bought the debt – as opposed to the first date of last delinquency – which is the only date to determine the actual age of the derogatory.

Debts are sold back and forth between collection agencies often and some Original Creditors may hold on to a debt for years before selling it off. Therefore the date that a collection agency purchases a debt has absolutely nothing to do with the age of the account. Consequently, when the new Collection Agency reports the old debt with the date they acquired it, the credit score responds as if it just happened. This absolutely affects the consumer’s risk level since the newer derogatory now has more of a negative impact on the credit score. I often see minor collections that are several years old, re-age in this way and drop a FICO score over 100 points! Is this fair and accurate scoring?

By the way, when reviewing any of the major Credit Bureaus’ forums and customer service questions, you’ll see many people writing in with concern due to this new date thinking that the collection agency that bought the debt had re-aged their account. This question has been asked so frequently that the bureaus have it under their FAQ section. They answer with the assurance that it simply represents the date the collection agency acquired the debt and that it has nothing to do with the statute of limitations. (The 7 year period a derogatory has before falling off the report.) Which is true.

The Bureaus have even gone so far as to add a new section on their consumer reports with a calculated date the derogatory would fall off the customer’s report. Again, this date is seven years from the original date of first delinquency, which is accurate and thus the concerned consumer is put at ease. Now someone needs to tell that to FICO, as they code the new date as if it is the age of the derogatory. So maybe it is scheduled to come off in two more years, but FICO codes it as if it just happened and completely destorys the credit score!

Collection agencies exploit this little secret when reporting and buying new debt. See my blog, Staring Down the Barrel of a Trigger lead, which goes into more detail about this subject. Collection agencies try to make their debt scream the loudest by passing debts among each other and buying up old debts based on a consumer’s buying pattern. And the loudest would be of course, the debt that brings down the credit score the most. As they sell the debt back and forth between their sister companies and other collection agencies in their network, creating new trade lines and new open date each time resulting in a yo yo effect and distressed credit scores. And what’s worse is – it’s legal!

I could go into all the blatant date manipulation the collection agencies do – which is, of course, not legal but that would be another whole blog in itself!

Then we have the fact that paying off old debt re-ages the account and – once again – creates an incorrect code with the date of last activity. This is the date the consumer paid it off which consequently reages the debt and drops the credit score in most cases. See my blog here for more info. Would you consider it fair and accurate scoring to dock or lower a person’s credit score just for paying off an old debt!?

What about this little fact – paying off a balance on a credit card to zero takes that account out of the utilization factor and drops the credit score. Is that a glitch!? In the performance history of those thousands of loans analyzed, are those people who paid their credit cards off going to be a risk factor? I seriously doubt it!

Now we can understand why people have such a difficult time trying to pull out of hard times and getting past storms in life, only to get stuck in the valley. We read about it and hear it often, “Just pay your bills on time. And you don’t have to worry about it.” Well no shit! I’d like to slap every moron that says that. Look, life happens people – it’s not just unicorns and rainbows but it includes shit storms too!

I kid you not – I had an old accountant companion who used to boast that remark arrogantly, “just pay your bills on time” – and guess who just so happens to be a client of mine right now? I guess he must of met that ol’ gal, Karma . Then we have the guy that tries to pull the old ethical card out, stating that we are somehow misleading the lender by manipulating the client’s credit history and therefore effecting the economy with bad loans and whatnot. I’d like to put that guy in a headlock and hand feed him these cold hard facts: what we are doing is completely the opposite – we are absolutely trying to ensure accurate information to the potential lender. And then I’d like to put my foot-of-facts right up his you-know-what!!! My apologies for the rant – I’m just extremely emotional about this. Plus these blogs aren’t just to educate you but they also make for a good personal purging!

The fact is this – if more people were able to buy homes, pay less interest rates, and put more of their hard earned money out on the streets – it would have a tremendous, positive impact on our economy! However, without some serious help, the average consumer is exposed and vulnerable to a mandated, yet ungoverned risk assessing mathematical algorithm full of glitches called FICO. The most important 3 digit number in person’s life and perhaps the banking system is f laud.

Unfortunately, I can’t force feed anyone this info and until the system changes, these are the cards we’re dealt with. However, my purpose and intentions are to give you the information that you need to navigate through this mess. I believe that in knowing this information, it absolutely will help you with creating a solution to re-establish your credit. We understand because we navigate through this mess daily as we advise our clients and build cases against the bureaus and creditors.

We use many methods that are specific to our company to prevent, circumvent, and correct these issues. I seriously cannot count all the clients I meet on a daily basis, that are so frustrated and ready to give up, because they can’t seem to recover and go forward with their lives. However, I LOVE seeing their hope return when we peel back the layers of misinformation and manipulation and show them the solution. It’s that look of confidence that we get with a good plan and a good look at the truth.

The world needs us! Other credit repair companies need to step up their game and learn the real issues so they can better serve their clients. Until then, we will continue to push these facts to our lawmakers in hopes that they can provide some sort of protection for consumers that is focused on risk based scores as this is a major issue. In the meantime, if you’ve fallen victim to this mess, call and schedule a free consultation.

However, if you’re a bit skeptical or if you’re calling BS on my blog, just schedule 3o minutes with me.

“We’re in the business of changing lives”

- Fico Exposed - December 9, 2017

- Making Payment Arrangements on Old Bad Debt - September 13, 2017

- Positive Versus Negative Credit - September 12, 2017

Call Now: (806) 853-8341

Call Now: (806) 853-8341